The insurance sector as a whole accounts for approximately £30bn in GVA.[1]ABI (2019), ‘The state of the market 2019’, p. 6. It accounts for 1.1% of total UK employment, and its net exports are over £15bn per year.[2]House of Commons exiting the European Union committee (2017), ‘Insurance and pensions sector report’.

The UK insurance industry comprises life insurance, general retail insurance, and commercial insurance. We focus in particular on those parts of the insurance sector where contracts are especially internationally mobile. In particular, we consider the ‘London Market’ as a cluster of insurance providers and support services that provide for specialty insurance and reinsurance for international corporate clients.

The London Market is the leading global insurance/reinsurance hub, accounting for approximately £80bn in gross written premium in 2018.[3]London Market Group (2020), ‘London matters 2020’, p. 9. It employs around 47,000 people and contributes 7.7% of London’s GDP, as well as the majority of the insurance sector’s exports.[4]London Market Group (2020), ‘London matters 2020’.

Indeed, the London Market is a particularly global one, with international risks accounting for 80% of premium underwritten.[5]EY (2019), ‘2020 UK Insurance outlook’.

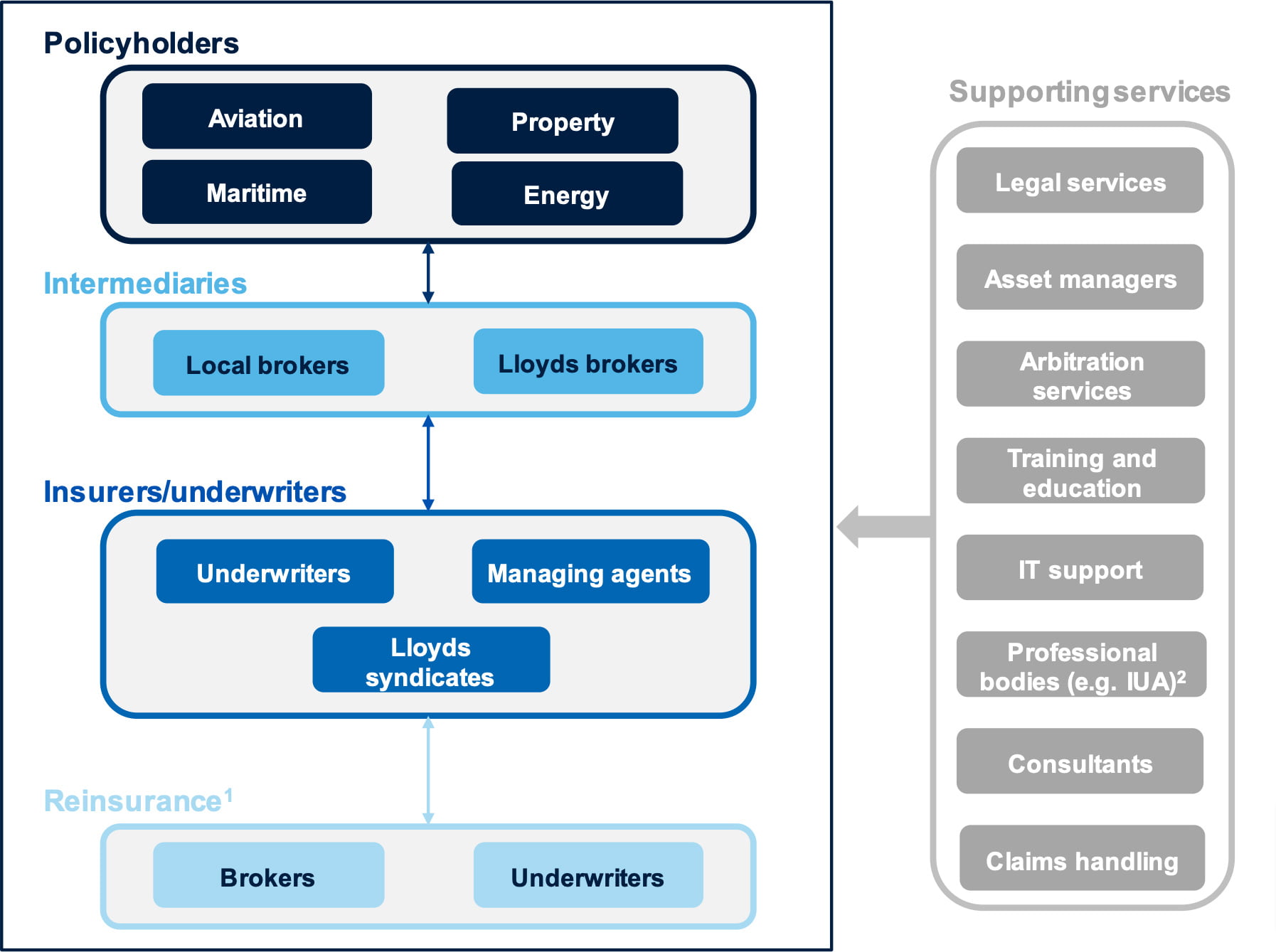

The London Market accounted for £15bn in direct GDP contribution in 2018, rising to £26bn when including indirect contributions.[6]London Market Group (2020), op. cit. A stylised diagram of the insurance value chain for internationally traded insurance/

reinsurance business is shown in Figure A1.4 below. We identify five broad categories within the overall value chain:

- policyholders—these are largely commercial firms (including firms from around the world) that seek to insure themselves against a certain risk, and to a lesser degree these also include individuals;

- intermediaries—the policyholder typically accesses insurance through a broker. This ‘local’ broker in turn may contact a ‘London Market’ broker;

- insurers/underwriters—these underwrite the risk and are backed by capital that secures the claim of the insured. At Lloyd’s of London, syndicates are groups made up of members who provide capital. A syndicate will have a managing agent who appoints the underwriter to insure/reinsure the risk on behalf of the syndicate;[7]For further explanation of the role of the syndicate (and other participants) at Lloyd’s of London, see ‘The Lloyd’s market’.

- reinsurance—in some cases, insurers transfer some of the risk to another insurer. On the whole this is done through a reinsurance broker, though it can also be done directly;[8]Reinsurers themselves also reinsure the risks they receive with other reinsurers (referred to as ‘retroceding the risk’). London is a very significant retrocession market in itself, though for … Continue reading

- supporting services—there is a wide range of additional supporting services, including claims handling, lawyers, asset managers and actuarial consultants.