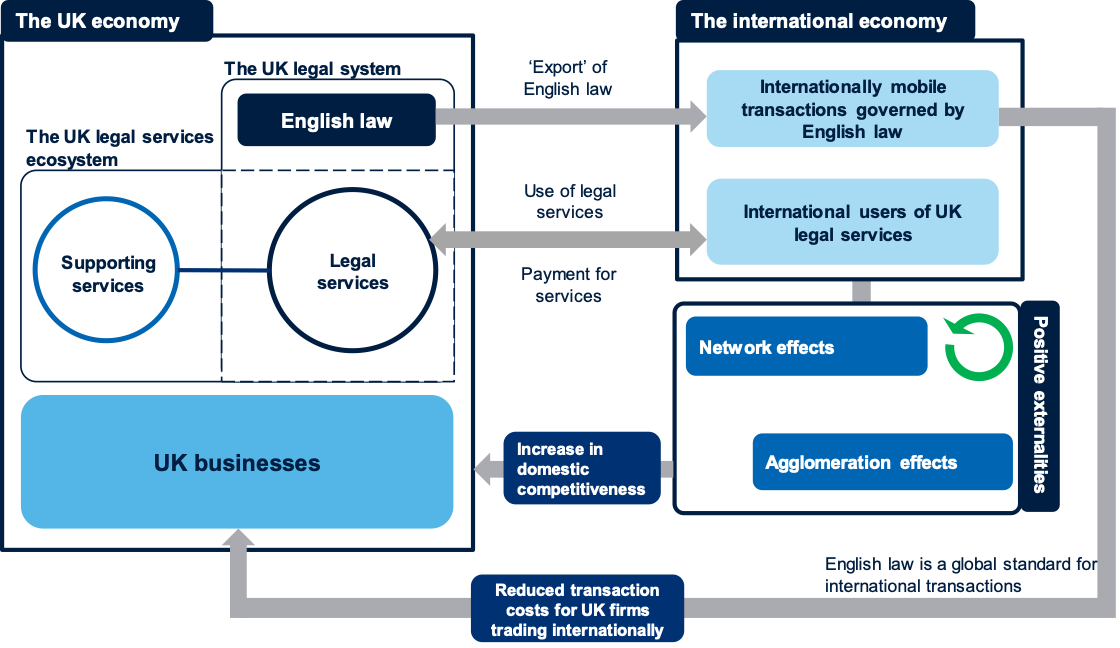

Finally, UK businesses that trade internationally benefit from the widespread global use of English law through their familiarity with it. The prevalence of English law internationally means that UK businesses are less likely to need to consult lawyers or set up an in-house legal counsel qualified in law other than English law. This reduces the transaction costs of trading internationally, especially for small and medium-sized enterprises, or those that trade in high-volume/low-value products.

Coupled with knowledge spill-overs and productivity increases due to agglomeration, lower transaction costs can increase the international competitiveness of UK businesses. This is likely to increase the level of economic activity that UK businesses can undertake abroad, generating value for the UK.