The global commodities market is very difficult to value in its entirety due to its vast size and the variety of commodities traded. However, it is possible to look at the UK’s position in global commodities trading through examining the position of UK commodities exchanges and trade associations.[1]A commodity trade association is a membership organisation that facilitates and promotes international trading of commodities and offers support to members in the form of contracts, arbitration, … Continue reading

The UK is home to the London Metal Exchange (LME), the world centre for non-ferrous metals trading.[2]London Metal Exchange (2020), ‘Guide to the London Metal Exchange’. Trading on LME platforms totalled $11.6tn in 2020.[3]Ibid.

The UK is also the location of a number of the world’s trade associations that issue standard form contracts that parties can adopt for on-exchange commodity trading.[4]It should be noted that commodity exchanges, such as the LME, also offer standard-form contracts for commodity trading. This includes the Grain and Feed Trade Association (GAFTA), the Federation of Oils, Seeds and Fats Association (FOSFA), and the Refined Sugar Association (RSA). The standard form contracts offered by these trade associations are commonly used for on-exchange commodity trading. 85% of the global trade in oils and fats is traded under FOSFA contracts,[5]FOSFA International (N.D.), ‘FOSFA International: About us’. and 80% of the global trade in grain is traded under GAFTA contracts.[6]GAFTA (N.D.), ‘Membership’.

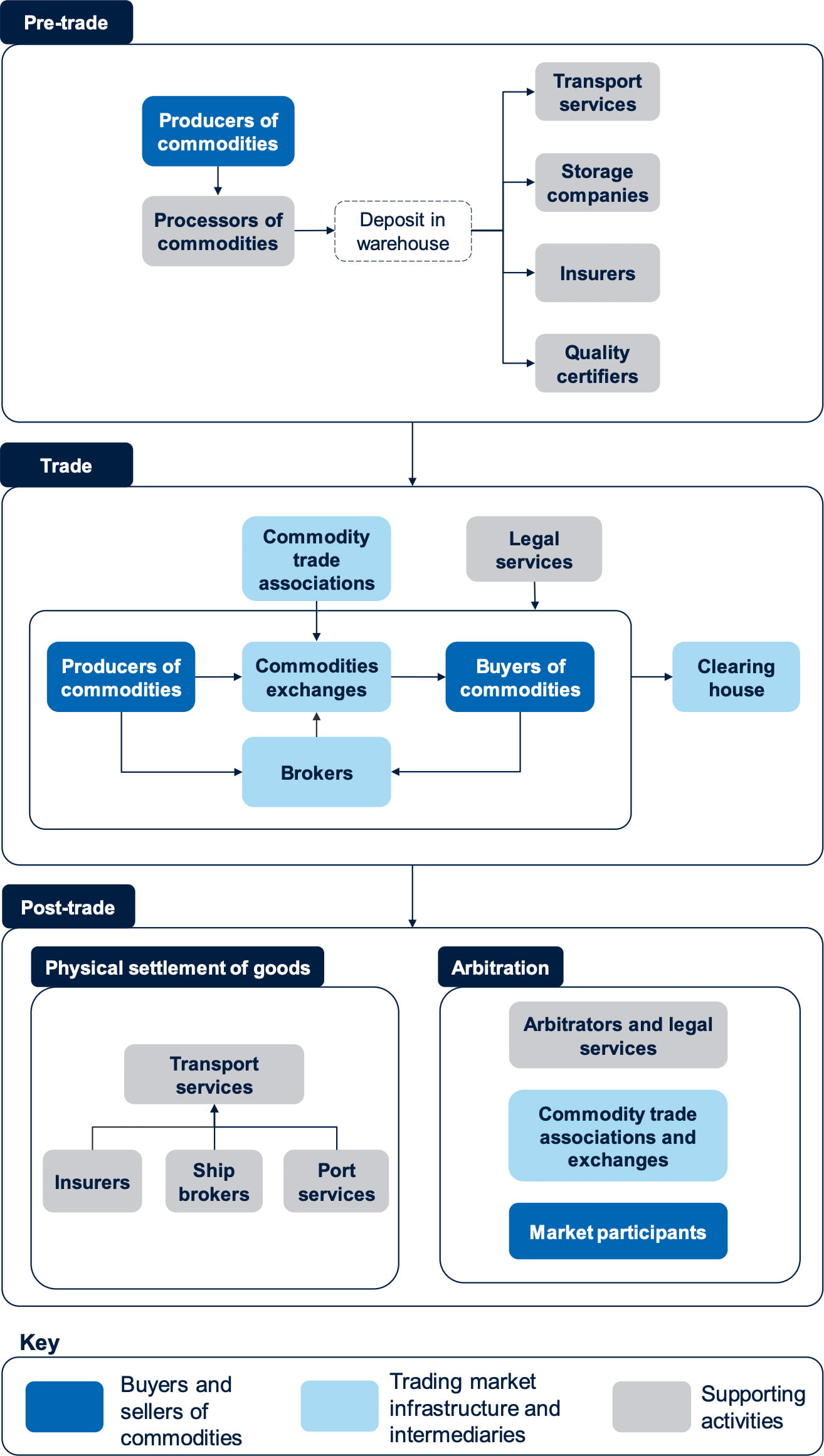

The UK’s position in global commodities trading generates significant value for the UK. Figure A1.2 provides a stylised illustration of the commodities trading ecosystem with the physical delivery of traded commodities.

Pre-trade, producers and processors are involved in the production of commodities. Raw and processed commodities for trade are then deposited in storage facilities approved and licensed by commodity exchanges. This involves a number of supporting activities, including transportation services and insurance services. Quality certifiers determine the quality and quantity of the commodity deposited in the storage facility and report this to the commodity exchange.

Producers and buyers trade commodities on the commodity exchange, where the commodity exchange provides a centralised marketplace for trading under standardised terms. Trade is facilitated by brokers, who bring buyers and sellers together, and commodity trade associations, which offer standard form contracts for on-exchange commodity trading. Trading is also supported by services such as legal services. Finally, clearing houses provide clearing and settlement services for trades.

Post-trade, the physical settlement of goods entails delivering the agreed upon quantity of the commodity to the buyer at the agreed date. This requires transport services, such as shipping, supported by a number of activities including insurance, ship brokers and port services. In the event of a dispute between contracting parties, arbitration services may be used.

As producers and buyers from anywhere in the world can trade commodities on exchange, not all of the activities illustrated in Figure A1.2 below will be based in the UK. However, where trading occurs on an exchange located in the UK and the transaction is governed by English law, this will generate value for the UK economy through the following channels.

- The financial, legal, and clearing activities associated with the trading of commodities on exchange and the activities of GAFTA, FOSFA and RSA generates value for the UK.

- GAFTA, FOSFA, RSA and the LME offer arbitration services in the event of disputes between transacting parties.[7]GAFTA (N.D.), ‘Arbitration’; RSA (2021), ‘Rules and Regulations’, 2 March; LME (N.D.), ‘Arbitration’; FOSFA (N.D.), ‘Arbitration’.

- Therefore, when arbitration is needed, UK legal services are likely to be used, generating value for the UK economy.

- As discussed in section A1.2, the use of English law to govern commodity transactions promotes English law as a global standard for these internationally mobile transactions.

- As outlined in section A1.1, the UK is a global hub of international maritime services. Therefore, the global trading of commodities generates additional value for the UK through the UK maritime sector.

Where the other activities illustrated in Figure A1.2 below do occur in the UK, further value will be generated for the UK.