- The OTC derivatives market is very difficult to value in its entirety due to its vast size. However, OTC interest rate derivatives are the most commonly traded type of derivative globally.[1]Bank for International Settlements (2019), ‘Triennial Central Bank Survey of Foreign Exchange and Over-the-counter (OTC) Derivatives Markets in 2019’. Global daily average turnover of OTC interest rate derivates was $7340bn in 2019, in which the UK accounted for 50% of this activity.[2]Ibid.

Looking at European derivatives trading, the size of the European OTC derivatives market in 2019 was €627tn. 82% of all European derivative trading involved a UK-domiciled counterparty in 2019.[3]European Securities and Markets Authority (2020), ‘EU Derivatives Markets ESMA annual Statistics Report 2020’.

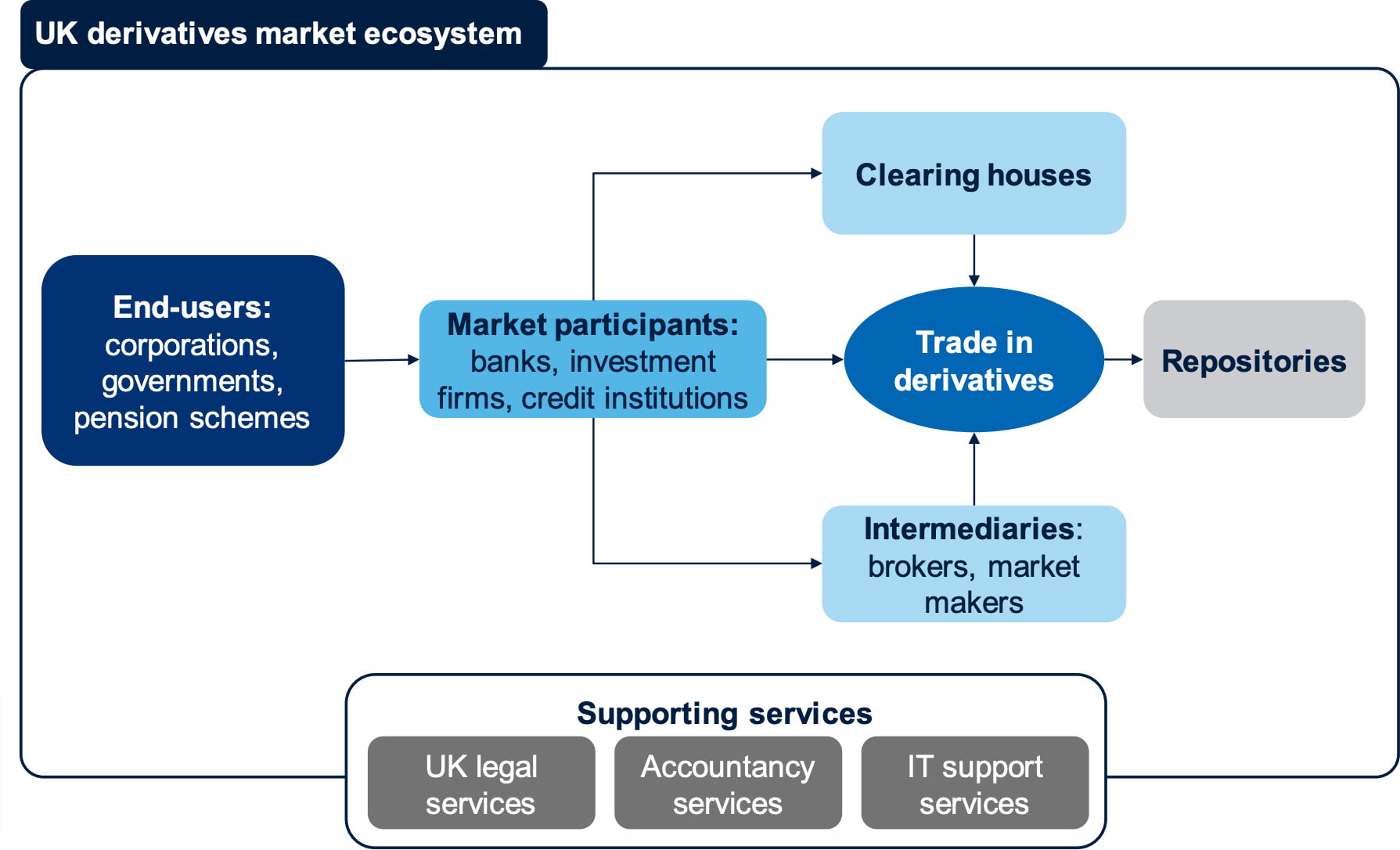

The UK’s substantial market share in global and European derivatives trading generates significant value for the UK through the UK derivatives market ecosystem. Figure A1.3 provides a stylised illustration of the UK derivatives market ecosystem.

Market participants such as banks, investment firms and credit institutions buy and sell derivatives, either for their own accounts, or on behalf of end-users including corporations, governments and organisations that provide investment services such as pension schemes.

Intermediaries and clearing houses facilitate the trading of derivatives. Intermediaries are those in the business of dealing, making a market, or intermediating derivatives transactions.[4]International Organisation of Securities Commissions (2012), ‘International Standards for Derivatives market intermediary regulation’, June. This includes brokers, who bring buyers and sellers together, and market makers—firms that are ready to buy and sell derivatives on a regular and continuous basis at a publicly quoted price.[5]Ibid. Clearing houses provide clearing and settlement services for trades, and can act as a central counterparty, where the clearing house sits between market participants as the counterparty to buyers and sellers.[6]Bank for International Settlements (2016), ‘Glossary’, October. It should be noted that in OTC bilateral clearing, market participants trade directly with one another and the clearing house does … Continue reading For example, the UK is home to the London Clearing House (LCH) and ICE Clear Europe. Finally, repositories collect and maintain records of derivatives transactions.[7]Ibid.

OTC derivatives transactions and the UK derivatives market ecosystem is supported by services such as legal services and accountancy services.[8]ISDA (N.D.), ‘About ISDA’. Legal services may be needed during pre-trade due diligence, particularly for complex derivatives transactions, or may be required upon disputes between counterparties.[9]The ISDA Master Agreement includes a provision specifying which courts can adjudicate upon any disputes about swaps governed by the Master Agreement.